Understanding Tax as a Deliveroo Rider

Deliveroo riders, as self-employed contractors, face unique challenges when it comes to managing their taxes. With earnings coming from various deliveries and potential expenses that could be claimed, understanding the tax landscape is crucial. Whether you're a newbie or a seasoned rider, keeping up-to-date with the latest tax tips can help you save a considerable amount of money.

The Pie Tax App, with its user-friendly interface and expert tax assistants, is designed to help you navigate through your tax responsibilities seamlessly. By leveraging such resources, riders can ensure that they are not overpaying taxes and can identify potential areas of savings.

In this article, we outline essential tips every Deliveroo rider should know to maximise their tax savings. Individual tips range from understanding allowable expenses to efficiently managing your records.

Track Every Penny Earned

One of the fundamental aspects of self-employment is keeping meticulous records of your income. For Deliveroo riders, this means logging each payment received from your deliveries. Not only does this practice ensure that you have a clear picture of your earnings, but it also assists in providing accurate information when it’s time to file your tax return. The Pie Tax App helps in simplifying this process, ensuring that every penny earned is recorded accurately.

Keep Track of Expenses

Expenses can significantly impact your taxable income; hence, it is important to keep detailed records of all deductibles. Allowable expenses might include the cost of your bike maintenance, protective gear, or even your phone bill if used for work purposes. By keeping a detailed log of these expenses, you can lower your taxable income and, consequently, your tax bill. Use the Pie Tax App to categorize and track your expenses efficiently.

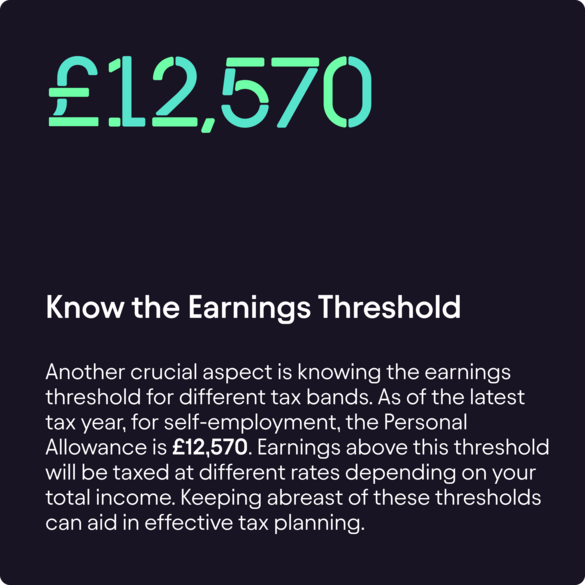

Utilise Tax Reliefs and Allowances

To maximise savings, it’s prudent to take advantage of all available tax reliefs and allowances. For instance, if you work from home, you may be able to claim a portion of your household expenses. Additionally, if you’ve purchased a new bike or equipment, the Annual Investment Allowance (AIA) could allow you to deduct full equipment costs up to a certain limit.

Using the Pie Tax App, riders can easily identify and apply for various tax reliefs and allowances. By leveraging these benefits, riders can significantly reduce their tax burden.

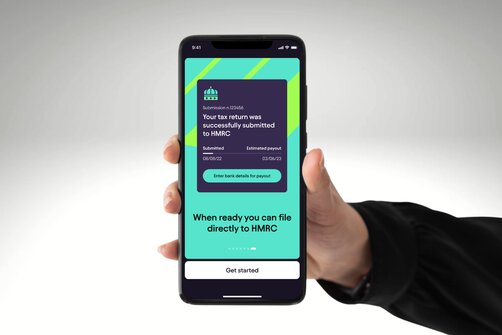

File Your Taxes on Time

Filing your tax returns on time is paramount to avoid unnecessary penalties. Late filing can attract a fine starting at £100 and can escalate depending on the delay. By maintaining orderly records throughout the year and making use of tools like the Pie Tax App, Deliveroo riders can ensure that they meet all deadlines. The app's reminders can be particularly handy in avoiding late submission penalties and keeping you on track.

Tips for Deliveroo Riders to Maximize Savings

Fun Facts

Did you know that the average Deliveroo rider covers nearly 14,500 kilometres annually? That's almost the distance of cycling from London to Sydney!

Seek Professional Advice

While the tips provided can significantly help in managing your taxes, seeking professional advice can be extremely beneficial. Consulting experts via the Pie Tax App can provide personalised tax planning strategies tailored to your specific needs. They can help in identifying additional deductions and allowances that you may not be aware of, ensuring that you're fully maximising your savings.

Expert tax assistants available through the Pie app can also help you understand and navigate complex tax legislations and ensure that your tax affairs are in order. This level of assistance can provide peace of mind and make the tax filing process less daunting.

Summary

Managing taxes as a Deliveroo rider can be complex, but it doesn’t have to be overwhelming. By keeping track of your income and expenses accurately, being aware of key numbers and rates, and utilising the available tax reliefs and allowances, you can significantly reduce your taxable income and maximise savings. Filing your taxes on time and seeking professional advice are essential steps to avoid penalties and ensure that you are compliant with tax regulations. The Pie Tax App and its expert tax assistants are invaluable resources that can simplify tax management and offer personalized guidance tailored to your needs.

Moreover, staying organised and regularly reviewing your finances can help you stay on top of your tax obligations throughout the year. With these steps, you can focus more on your deliveries and less on your tax worries.