Introduction to Autonomous AI in Professional Services

The advent of autonomous AI agents is revolutionising the landscape of professional services. These intelligent systems are designed to perform tasks traditionally handled by humans, offering unprecedented efficiency and accuracy. From software development to accounting, AI agents are redefining how professionals approach their work, leading to streamlined processes and enhanced productivity.

One notable example is Devin AI, an autonomous assistant developed by Cognition Labs. Branded as an "AI software developer," Devin AI can autonomously perform software engineering tasks, including coding, debugging, and problem-solving. Users provide a natural language prompt, and Devin AI generates a plan, implements code, and even searches online resources to complete tasks. This capability allows for rapid development cycles and reduces the potential for human error.

In the realm of accounting, AI agents are making significant strides. By automating routine tasks such as data entry, tax calculations, and financial reporting, these systems free up accountants to focus on more strategic activities. The integration of AI in accounting not only enhances accuracy but also ensures compliance with ever-evolving financial regulations.

AI Agents Will Transform Accounting

AI Agents are set to change everything. Unlike traditional AI models, which are limited to their training data, AI Agents have the ability to use software and tools just like humans.

HMRC’s Portal Does the Job. But Is It Enough?

Yes, the UK government has a portal for submitting your taxes, and it does what it needs to. But for many, the forms, the jargon, and the endless maze of questions feel like an uphill battle. Even when you understand the process, I am sure it still feels like a headache.

We asked ourselves: In an age where digital banking, ordering takeout, and booking a taxi are easier than ever, why hasn’t tax been modernised? Almost everyone has to deal with it, yet it remains unnecessarily complex.

The Pie Tax App: A Modern Tax Solution

From the start, we've focused on making tax submissions as intuitive as possible. We've worked hard to create a user-friendly app that connects your bank account, categorises transactions, marks deductible expenses, and easily submits Self-Assessments directly to HMRC.

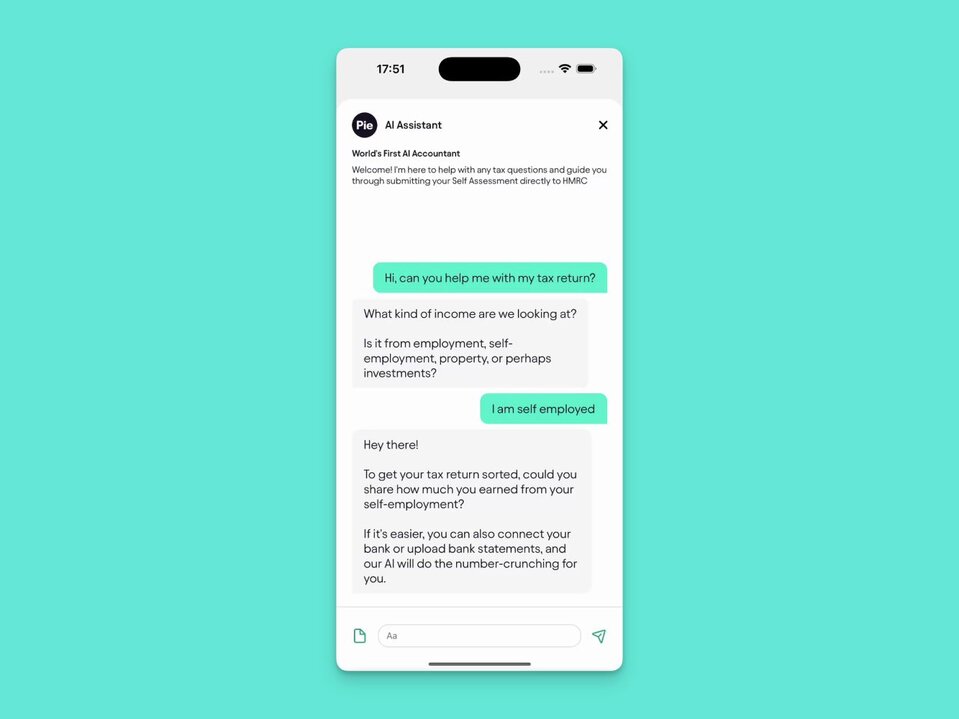

As we continued to innovate, an exciting idea hit us: “What if we could make this even easier?” It turns out the simplest solution is also the most natural, and for us humans, nothing feels more intuitive than having a conversation.

Recent statistics indicate a 72% adoption rate of AI technologies among organisations, a substantial increase from previous years. This surge reflects a growing trust in AI's ability to enhance efficiency and accuracy in professional services.Significant Growth in AI Adoption

In October 2023, AutoGPT, an open-source autonomous AI agent, secured £12 million in funding to advance its capabilities. This investment underscores the confidence investors have in the potential of AI agents to transform various industries.Investment in AI Development

Seamless AI-Powered Bookkeeping and Tax Filing

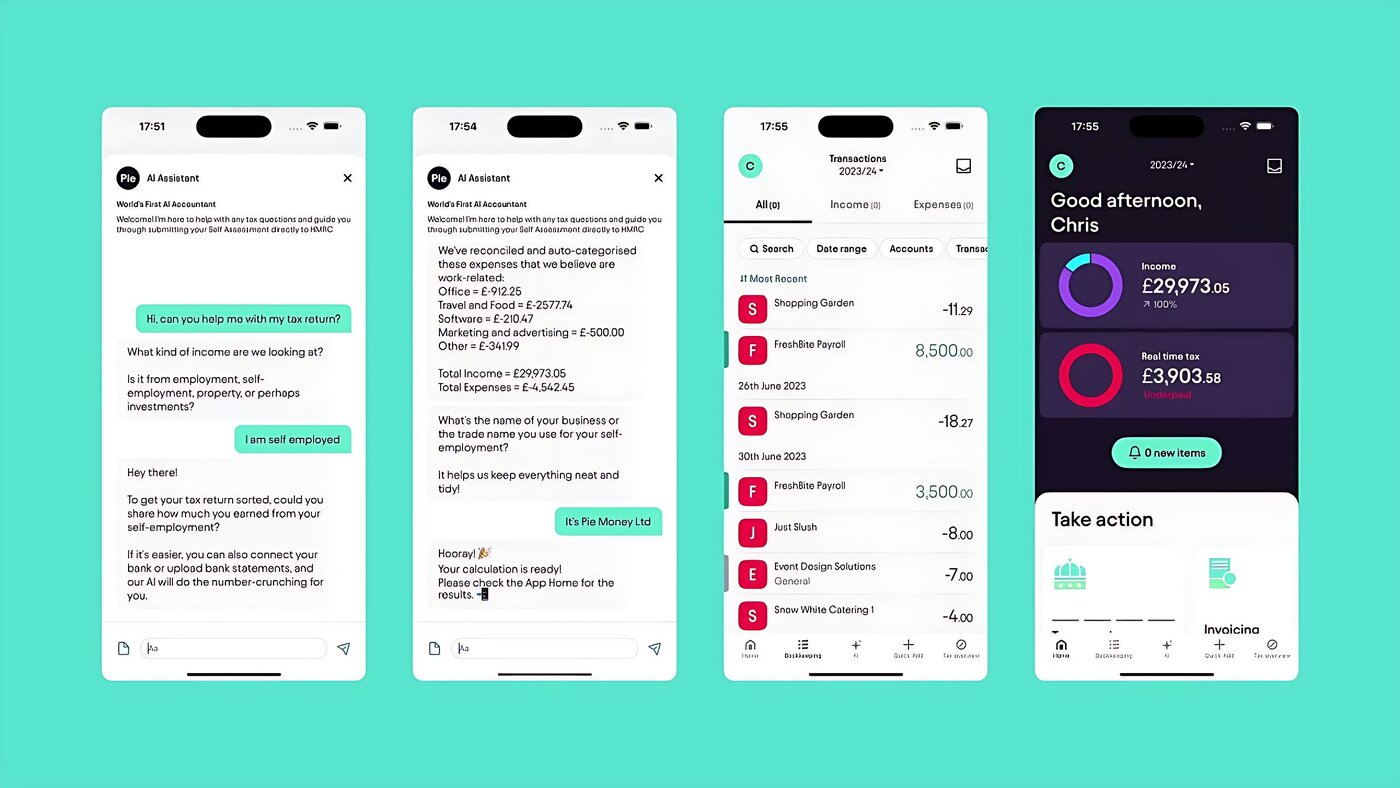

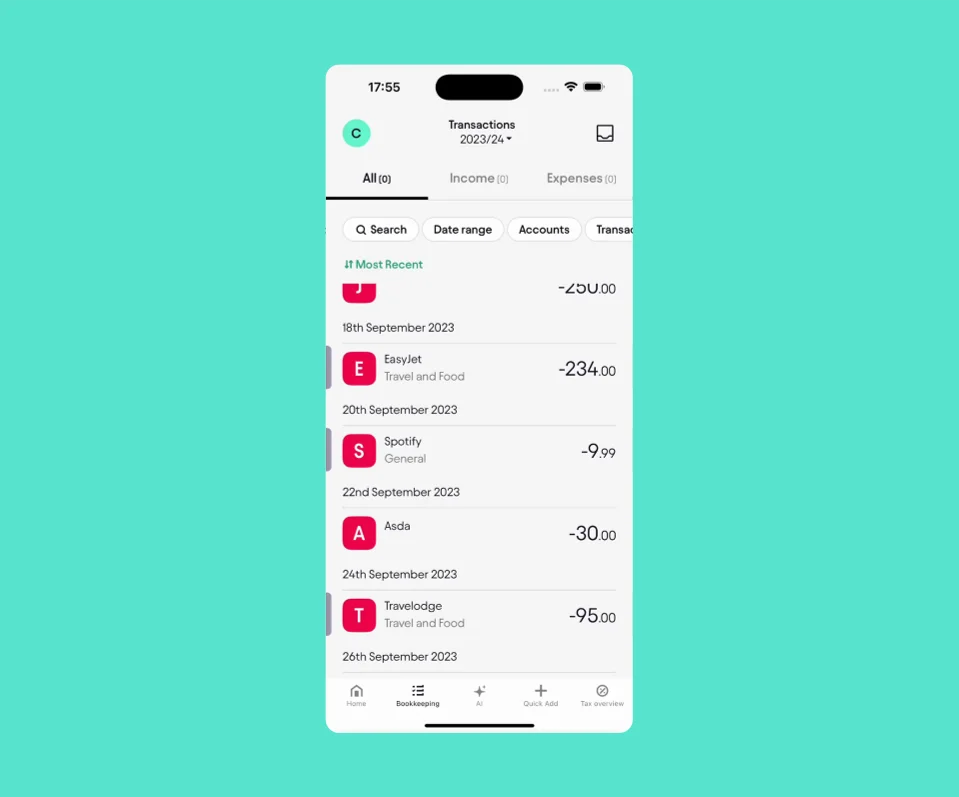

When asked about your income and expenses, you can enter the amounts, connect your bank, or upload bank statements. The AI agent processes transactions, auto-categorises work-related expenses, and reconciles deductibles without manual input.

For example, after uploading a bank statement (.csv), the system identifies income and expenses, grouping them into categories like Office, Travel, Software, and Marketing. During the chat, users are prompted to upload statements, and AI analyses transactions to find deductible expenses.

A summary of findings is shared for transparency before adding the processed data to bookkeeping. The fully reconciled records are then ready for review and submission to HMRC, ensuring a seamless and automated tax filing experience.

AI's Impact on the Accounting Profession

In the accounting sector, the adoption of AI agents is transforming traditional practices. By automating routine tasks such as data entry, tax computations, and financial analysis, AI allows accountants to focus on strategic decision-making and client advisory roles.

The precision of AI in handling complex calculations ensures compliance with financial regulations and reduces the risk of errors. The Pie Tax App exemplifies this transformation by offering expert tax assistance.

It streamlines the tax filing process, provides real-time updates on tax laws, and ensures users maximise their eligible deductions. By leveraging such AI-driven solutions, individuals and businesses can navigate the complexities of taxation with ease and confidence.

Top AI-Powered Tax Tips for Effortless Filing

Pie's AI-powered accountant simplifies tax management with advanced tools, ensuring seamless automation and accuracy in tax calculations and submissions.The AI Agent’s Capabilities

It connects bank accounts, uploads documents, auto-categorises expenses, and identifies tax-deductible work-related costs, reducing manual effort and errors.Smart Expense Management

With real-time tax calculations, customer support access, and direct HMRC submissions, tax compliance becomes faster, easier, and stress-free.Effortless Tax Filing

Fun Fact

Did you know that over 54% of longer English-language posts on LinkedIn are likely AI-generated? This statistic highlights the pervasive influence of AI in professional content creation.

The Future of AI in Accounting

Traditional accounting is riddled with complexities tax forms, expense categorisation, and endless emails with tax support make the process tedious. Startups, with their agility, are driving innovation, overcoming the limitations of traditional accounting software, which often feels outdated and difficult to use. While LLMs excel at processing language, they lack the precision and action-oriented capabilities required for seamless tax management.

By integrating AI with the right tools, we unlock agentic AI, an intelligent system that not only understands context but also acts. Imagine an AI accountant that calculates tax, reconciles expenses, and submits directly to HMRC, eliminating stress and inefficiency. This technology is revolutionising accountancy, making tax filing a simple conversation rather than a complicated process.

Integrating AI into industry-specific processes enhances efficiency and accuracy. Businesses should adopt AI tools that align with their unique needs, automating repetitive tasks while improving decision-making. Encouraging AI-driven innovation fosters creative problem-solving, helping organisations stay competitive and adapt to evolving market demands.Key Strategies for AI Integration

As AI capabilities advance, automation in professional services will become more sophisticated, streamlining complex processes with greater efficiency. AI's role in compliance and regulation will evolve, ensuring businesses meet legal requirements seamlessly. This transformation will enhance accuracy, reduce manual work, and optimise operations.The Future of AI in Professional Services

Summary

AI agents are transforming tax management but won’t replace accountants entirely. While Large Language Models (LLMs) understand and generate human-like language, they have limitations. When combined with AI agents using external tools like databases and tax software, they streamline tax filing. The Pie Tax App simplifies self-assessments by connecting bank accounts, categorising expenses, and submitting returns directly to HMRC.

Users can interact naturally with the AI agent, eliminating complex forms. It auto-categorises transactions, identifies tax-deductible expenses, and reconciles records in real time. With Making Tax Digital (MTD) launching in April 2026, digital tax tools are essential. Pie Tax ensures compliance, making tax filing stress-free. AI-driven bookkeeping and tax automation are the future, offering efficiency and accuracy.

Frequently Asked Questions

What are autonomous AI agents?

Autonomous AI agents are advanced AI systems capable of independently performing tasks such as coding, data analysis, and accounting with minimal human intervention.

How do AI agents improve efficiency in professional services?

AI agents automate repetitive tasks, allowing professionals to focus on high-value strategic work, thereby increasing overall efficiency.

Can AI replace accountants and software developers?

AI enhances these professions by automating routine tasks, but human expertise is still essential for complex decision-making and strategic planning.

What industries benefit the most from AI agents?

Industries such as software development, finance, healthcare, and legal services are seeing significant benefits from AI-driven automation.

How can businesses start integrating AI into their workflows?

Businesses should begin with pilot projects, invest in employee training, and gradually expand AI adoption based on measurable outcomes.