Understanding UK Tax Rates

Are you a taxpayer in the United Kingdom, puzzled about how tax rates work? Worry not! We've got you covered with a comprehensive guide on understanding and navigating UK tax rates effectively.

Understanding UK Tax Rates

When you need to manage your personal taxes, it's crucial to understand the various components of the tax system:

Individual income tax rates are tiered in the UK, meaning the rate you pay depends on your income level. Understanding these bands helps you estimate your tax liabilities accurately.Income Tax Bands

Personal Allowances allow taxpayers to earn a certain amount of income tax-free each year. Knowing your allowances is essential for optimal tax planning.Allowances

NICs are payments made to qualify for certain benefits and the State Pension. Understanding your NIC obligations ensures you stay compliant and attain your benefits.National Insurance Contributions

How to Manage Your UK Taxes

Follow these steps to manage your UK taxes seamlessly:

Identify your total income for the tax year.

Determine the applicable tax band for your income.

Calculate your personal allowance.

Assess your National Insurance Contributions.

Submit your tax return through the HMRC website or via tax software like Pie App.

Options for Submitting Your Self-Assessment

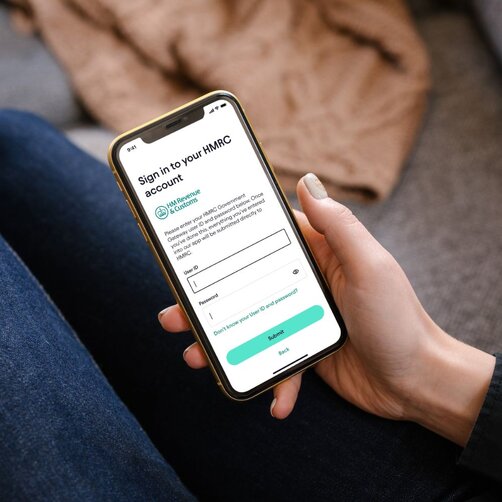

Option 1: Using HMRC Online Services

HMRC Online Services is a popular and official method for submitting tax returns directly through HMRC’s interface, where you need to manually input information and calculations. This platform provides a secure and straightforward way to file your taxes, ensuring that your submissions are directly processed by HMRC. It also offers various tools and resources to help you accurately complete your tax return, making it easier to comply with your tax obligations.

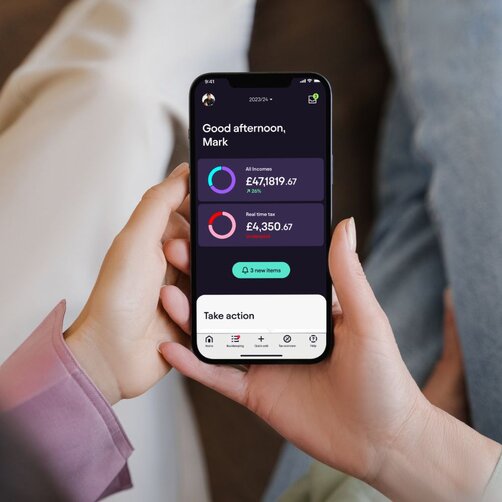

Option 2: Utilising Tax Software like Pie Tax

The Pie App automates the tax filing process, minimises errors, and ensures comprehensive compliance by integrating current tax laws and rates. It simplifies complex tax calculations, making it easier for users to manage their finances with confidence. The app also provides real-time updates on any changes to tax laws, helping you stay informed and adjust your tax strategies accordingly.

Additional Considerations

UK tax rates change with new government budgets, affecting finances. Staying informed helps you plan and adjust your strategies effectively.Staying Updated on Budgets

Knowing about tax rate changes is key for planning. Anticipating adjustments helps manage obligations and reduce liability.Effective Planning Strategies

Tax relief options like student loan reductions, marriage allowance, and business expenses can lower your tax liability. Using these effectively can lead to significant savings.Minimising Tax Liability with Relief Options

Expert Assistance with Pie

Navigating the complexities of UK tax rates can be daunting, but with pie.tax, you have access to expert tax services that guide you through every step. Pie.tax simplifies the tax filing process, ensuring you remain compliant and maximise your allowances. Get started with pie.tax today to make tax stress a thing of the past!

In the 2021-22 tax year, the personal allowance was £12,570, allowing many individuals to earn tax-free income up to this threshold.

As of April 2023, the higher rate tax threshold is £50,270, meaning any income above this amount is taxed at 40%.

Frequently Asked Questions

What is the basic rate of income tax in the UK?

The basic rate is currently 20% for income between £12,571 and £50,270 (as of April 2023).

How much is the National Insurance Contribution?

NICs vary based on earnings and employment category, starting from 12% for earnings between £9,884 and £50,270.

Can I split my personal allowance with my spouse?

Yes, under the Marriage Allowance, you can transfer £1,260 of your personal allowance to a low-earning spouse or civil partner.

What happens if I earn above the additional rate threshold?

Income above £150,000 is taxed at the additional rate of 45%.

How do self-employed individuals report their income?

lf-employed individuals must file a Self Assessment tax return annually via the HMRC portal or through tax software.

Frequently Asked Questions

What is the basic rate of income tax in the UK?

The basic rate is currently 20% for income between £12,571 and £50,270 (as of April 2023).

How much is the National Insurance Contribution?

NICs vary based on earnings and employment category, starting from 12% for earnings between £9,884 and £50,270.

Can I split my personal allowance with my spouse?

Yes, under the Marriage Allowance, you can transfer £1,260 of your personal allowance to a low-earning spouse or civil partner.

What happens if I earn above the additional rate threshold?

Income above £150,000 is taxed at the additional rate of 45%.

How do self-employed individuals report their income?

Self-employed individuals must file a Self Assessment tax return annually via the HMRC portal or through tax software.