Understanding Claiming Telephone Bill Expenses

Are you a UK sole trader puzzled about how to claim your telephone bill expenses on your self assessment? Worry not! We've got you covered with a comprehensive guide on how to accurately claim your telephone bill expenses.

Understanding Telephone Bill Expense Claims

When you claim telephone bill expenses, it's crucial to understand the related components:

Distinguish between the portion of the bill used for business purposes and for personal use. Only the business portion is deductible.Personal vs Business Use

Maintain detailed records and receipts of your telephone expenses to justify your claims to HMRC.Accurate Record-Keeping

Different methods can be used to calculate the proportion of your telephone bill attributable to business use, ensuring you're claiming the correct amount..Method of Calculation

How to Claim Telephone Bill Expenses

Follow these steps to claim your telephone bill expenses seamlessly:

Identify and separate the costs that are strictly business-related.Separate Your Bills

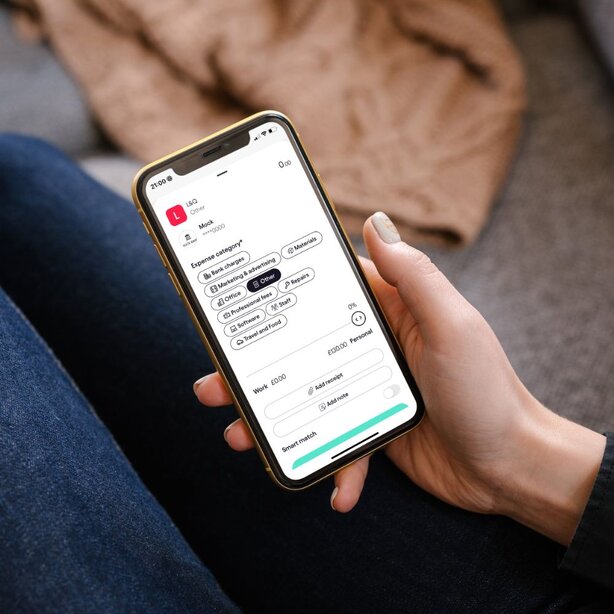

Determine the proportion of calls and data used for business purposes. The Pie App expense section allows you to edit your expenses according to the accurate percentage usage.Calculate Business Use Proportion

Document each business call, ensuring you have a record to back up your claim.Keep Detailed Records

Include the business use proportion of your telephone bill in the bookkeeping section on the Pie app before you submit. Complete Your Self-Assessment

Save all relevant bills and records as evidence in case HMRC requests verification.Retain Supporting Documents

Options for Submitting Your Self-Assessment

Option 1: Direct Calculation

With this method, you carefully examine your itemized bill to pinpoint specific calls and data usage that are directly tied to your business activities. This approach allows for precise allocation of expenses by identifying each individual business-related cost on the bill. It ensures accuracy but may require more detailed record-keeping and analysis. This method is ideal for businesses with varying usage patterns or those needing precise documentation for tax purposes.

Option 2: Estimate Method

This approach involves estimating the percentage of your total usage that is business-related based on a representative period. You then apply this percentage to your entire bill to determine the business expense portion. While less precise than direct calculation, this method can be more convenient and quicker, especially if your business usage is consistent over time. It’s particularly useful for small businesses where the time saved outweighs the need for exact calculations.

Additional Considerations

Always refer to the latest HMRC guidelines to ensure compliance and understand any updates to tax rules.HMRC Guidelines

If you use a single line for both business and personal reasons, ensure you only claim the relevant business portion.Mixed-Use Line

If you operate from a home office, consider the broader home office expense claims, which can also encompass telephone bills.Home Office Deduction

Expert Assistance with Pie

Navigating claiming telephone bill expenses can be complex, but with Pie Tax, you have access to expert tools and support to guide you through the process. Let Pie Tax simplify your self assessment with intuitive software and professional assistance.

65% of UK sole traders regularly claim telephone expenses in their self assessments.

Approximately 40% of small business owners fail to claim their full entitled telephone expenses due to lack of knowledge.

Frequently Asked Questions

Can I claim the whole telephone bill as a business expense?

No, only the portion related to business use can be claimed.

How should I calculate the business use proportion of my telephone bill?

You can either directly identify business calls or estimate a business usage percentage based on a typical period.

Do I need to keep my telephone bills as proof?

Yes, maintaining accurate records and bills is essential in case HMRC requests proof.

Can I claim telephone expenses if I use my mobile phone for business?

Yes, but you need to separate personal and business use and claim only the business portion.

Are there any tools that can help me track my telephone use for business purposes?

Yes, several mobile apps and software solutions, including Pie Tax, can help track and document business use effectively.