Avoid Jail Time for Tax Evasion

Failing to address your tax responsibilities can have severe consequences, including imprisonment. Many individuals may not realise that the UK takes tax evasion very seriously. The HMRC (Her Majesty's Revenue and Customs) is vigilant when it comes to ensuring compliance, and non-payment of taxes could lead to legal troubles.

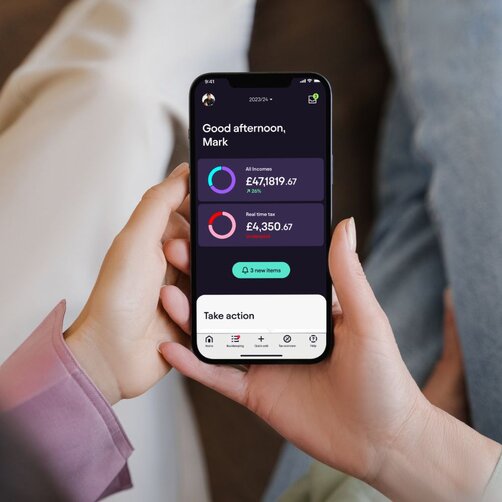

When it comes to tax evasion, understanding the repercussions is crucial. Jail time is a distinct possibility if deliberate efforts to avoid paying taxes are discovered. The best way to prevent such severe outcomes is by being well-informed, utilising resources like the Pie Tax App for timely submissions, and ensuring all tax returns are accurate and complete.

The Pie Tax App offers expert tax assistants available on the Pie app to guide you through the tax filing process, ensuring you stay compliant and avoid potential penalties, including imprisonment.

Common Penalties and Fines

In the UK, the consequences of not paying taxes are substantial. First, the HMRC imposes fines which can quickly escalate. For a late tax return, the penalty can be £100, followed by additional daily penalties. Accumulated fines can become financial burdens, making it essential to adhere to deadlines.

Secondly, if you owe money beyond the filing deadline, interest on unpaid taxes starts to accrue. This can significantly increase the amount you owe, intensifying your financial distress. The Pie Tax App can help you keep track of deadlines and any tax amounts due, reducing the risk of such penalties.

Severe Legal Consequences

Tax evasion carries severe consequences beyond fines. One alarming possibility is criminal prosecution. Deliberate actions to evade tax payment can lead to severe legal consequences, including imprisonment. Public records show that numerous individuals have faced jail time for such offences, underscoring the seriousness of tax compliance.

Additionally, HMRC has the authority to open investigations and use various methods to detect tax evasion activities. Being proactive in meeting your tax obligations with the aid of the Pie Tax App can keep you out of legal trouble by ensuring your records are correct and submitted on time.

In recent years, HMRC has increased fines related to tax evasion. For example, penalties for offshore tax evasion can reach up to 200% of the unpaid tax. This escalation is part of the UK's effort to clamp down on tax evasion and encourage compliance.

In 2020, UK taxpayers faced over £2 billion in tax evasion fines, signaling HMRC's robust approach to combating non-compliance. These high fines serve as a warning for anyone considering evading tax payments.

Strategies to Avoid Penalties

Understanding the magnitude of the penalties is key to avoiding them. Always file your tax returns promptly and ensure accuracy in your financial documentation. Misreporting, whether intentional or accidental, can lead to fines and, in extreme cases, criminal charges.

Proactivity is important. Use the Pie Tax App to stay on top of your tax obligations. It offers expert tax assistants available on the Pie app, ensuring you file correctly and on time. Filing late or failing to pay can warrant hefty fines and increase interest rates, magnifying your financial burden.

Another strategy involves transparency with HMRC. If you find discrepancies in your filings, reporting them promptly can mitigate potential fines. The HMRC is more lenient towards self-reported errors, showing a willingness to resolve tax issues beforehand.

The Role of Professional Help

Seeking professional help significantly reduces the risk of non-compliance. The complexity of tax laws can be overwhelming, making it beneficial to consult experts. The Pie Tax App provides you with reliable expert tax assistants available on the Pie app, ensuring every detail of your tax return is handled meticulously.

Additionally, professionals can help you navigate the intricacies of tax rebates, deductions, and allowances. This tailored advice enhances your understanding and helps you make informed decisions, reducing the risk of errors that could lead to penalties or imprisonment.

Leveraging professional help ensures your tax filings are accurate and timely. You can avoid legal consequences and maintain peace of mind, knowing experts are handling your financial documentation with precision.

Helpful Tips to Stay Compliant

Maintain all receipts, invoices, and any documentation relevant to your taxes. Good record-keeping ensures you can provide evidence if HMRC requests it.Keep Meticulous Records

This ensures your tax returns are filed accurately and on time. Subscription to expert services available on the Pie Tax App offers personalised assistance. Use reliable software tools

The UK tax system can undergo modifications, impacting your obligations. Understanding these changes enables you to file correctly, avoiding potential fines.Stay Informed

Fun Facts

Did you know tax evasion was the only crime Al Capone was convicted for? Despite his notorious crimes, it was unpaid taxes that landed him in jail.

Steps to Address Tax Issues

Addressing tax issues promptly can help you avoid legal trouble. If you're unsure whether you have met your tax obligations correctly, utilising solutions like the Pie Tax App can be crucial. This tool gives you access to expert tax assistants who can review your returns and ensure everything is in order.

If you receive communication from HMRC regarding discrepancies or unpaid taxes, respond immediately. Ignoring these notices only exacerbates the problem. Instead, promptly. Seek advice from professionals, utilising the resources available on the Pie Tax App to address the issues raised.

Set up a payment plan if you owe back taxes. Most taxpayers are unaware that HMRC offers the flexibility to pay outstanding taxes in installments. Doing so can alleviate immediate financial strains and foster good standing with tax authorities.

If you owe taxes, contact HMRC to discuss payment plans. They offer installments to ease financial burdens. Proactively setting this up shows good faith in resolving your tax obligations. Promptly addressing potential issues can demonstrate your willingness to comply. Use the Pie Tax App to facilitate this, ensuring expert guidance throughout the process.Payment Plans Available

Professional advice is invaluable in resolving tax issues. Whether it's understanding complex tax codes or negotiating payment plans, professional assistance through the Pie Tax App can be instrumental. Experts on the Pie Tax App can review your filings, identify errors, and advise you on corrective measures. This support helps you stay compliant with tax laws, avoiding penalties and legal troubles.Seek Professional Help

Summary

Tax evasion can lead to serious consequences, including imprisonment. Not paying taxes is not just about financial fines; it can result in criminal charges if deemed deliberate. The importance of staying compliant cannot be overstated.

Using tools like the Pie Tax App guarantees you're meeting all deadlines and that filings are accurate. By consulting professional tax assistants available on the Pie app, you benefit from personalized advice, reducing the risk of errors or misreporting.

In conclusion, understanding the severity of tax evasion, taking proactive measures to file accurately and timely, and seeking professional help are all essential strategies to avoid severe penalties and legal trouble. Staying informed and leveraging tools like the Pie Tax App makes navigating tax responsibilities manageable and stress-free.

Frequently Asked Questions

What are the penalties for late tax payments in the UK?

Penalties start with a £100 fine for late returns, progressing to daily penalties for continued non-compliance. Using the Pie Tax App helps you meet these deadlines and avoid fines.

Can HMRC investigate my taxes without notifying me?

Yes, HMRC can conduct random checks and investigate tax fraud or evasion. Turn to the expert tax assistants available on the Pie app to ensure compliance and maintain accurate records.

How can I reduce my chances of making tax errors?

Consulting professionals can greatly reduce errors. The expert tax assistants available on the Pie app offer unparalleled accuracy, ensuring your filings align with HMRC requirements.

What if I cannot pay my taxes immediately?

HMRC offers payment plans for outstanding taxes. Open communication with HMRC and expert advice through the Pie Tax App can facilitate these arrangements.

Is there a difference between tax avoidance and tax evasion?

Yes, tax avoidance is legal and involves planning to minimise tax. Tax evasion is illegal and includes deliberate misrepresentation to reduce tax liability. The Pie Tax App provides advice to keep you on the right side of the law.