Introduction to CIS and Subcontractor Hierarchies

The Construction Industry Scheme (CIS) is crucial for subcontractors in the UK, especially when considering expanding their operations by hiring their own subcontractors.

This article explores the complexities and responsibilities that subcontractors face under the CIS when they decide to engage other subcontractors. Understanding these dynamics is essential for compliance and effective management of construction projects.

Pie Tax provides tools and guidance, enabling subcontractors to navigate this complex field efficiently with the support of expert tax assistants available on their app.

Subcontractor Responsibilities

Subcontractors must ensure compliance by verifying and registering their subcontractors with HMRC. This not only guarantees tax compliance but also fosters trust and transparency within construction projects.

Hiring Your Own Subcontractors

When hiring subcontractors, ensure they are verified through the CIS verification process. Accurate payment deductions and thorough record-keeping are critical aspects of this process.

In 2022, over 1 million subcontractors were registered under CIS, emphasizing its vast scale. Effective management of this network is paramount for compliance.Recent CIS Statistics

Yearly, HMRC processes over £3 billion in deductions via CIS, highlighting the importance of maintaining accurate records and timely submissions to avoid financial penalties.Compliance and Deductions

Steps for Subcontractors to Hire Under CIS

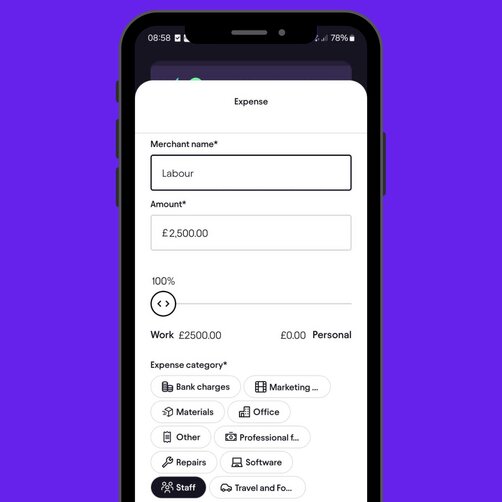

Subcontractors planning to hire their own subcontractors need to follow specific steps to comply with CIS requirements. First, they should ensure their subcontractors are registered with HMRC. This involves a verification process to ensure proper tax deductions are made. The Pie Tax App simplifies this with a streamlined interface and dedicated support, ensuring that subcontractors can efficiently manage this verification process.

Effective payroll management is another critical aspect. Subcontractors must keep accurate records of payments and deductions, ensuring timely submissions to HMRC. These practices not only keep the subcontractors compliant but also enhance their business reputation by fostering transparency and reliability.

Benefits of Using the Pie Tax App

The Pie Tax App offers a user-friendly solution for subcontractors to manage their CIS obligations. Its innovative features simplify complex tasks such as tax calculations and submissions, reducing the burden on subcontractors. Additionally, the app ensures compliance with CIS guidelines, mitigating risks of penalties due to non-compliance.

Moreover, the app provides access to expert tax assistants who are readily available to help navigate challenging tax situations. This means that subcontractors can focus on their core business activities, assured that their tax affairs are in capable hands.

Top Tips To Pay Your Own Subcontractors

Check Subcontractor Registration First, ensure that your subcontractors are registered under CIS. This guarantees that the correct tax deductions are applied, preventing unnecessary tax liabilities for both parties.

Confirm Payment Arrangements Second, confirm the payment arrangements. You must deduct tax from your subcontractors’ payments and report these deductions to HMRC, ensuring compliance with CIS regulations.

Maintain Accurate Records Lastly, keep accurate records of all transactions. Document payments and deductions meticulously to avoid potential disputes and ensure smooth financial management within the CIS framework.

Fun Facts

Fun fact: The CIS scheme was first introduced in 1971 to reduce tax evasion in the construction industry. Since then, it has undergone various transformations to improve tax compliance, making it easier for subcontractors to manage their fiscal responsibilities.

How to Handle CIS Challenges

Handling CIS challenges requires understanding and organisation. First, subcontractors should familiarise themselves with the compliance requirements of CIS to avoid potential penalties. Using the Pie Tax App, they can streamline these processes, ensuring all aspects of the scheme are adhered to efficiently.

Additional support from expert tax assistants can be invaluable. Seeking professional advice can help subcontractors address complex situations and ensure they remain compliant and efficient in their operations.

Always keep your CIS records up to date. Regular audits and checks can prevent compliance issues. Compliance Tips

Utilise technologies like the Pie Tax App for accurate and timely tax submissions. Leverage external expertise when needed.Tax Efficiency

Summary

The CIS framework plays a critical role in maintaining financial propriety in the construction industry. Subcontractors must navigate this system effectively, particularly when hiring their own subcontractors. Proper registration, verification, and diligent record-keeping are critical components of compliance. The Pie Tax App provides an integrated solution, assisting subcontractors in managing their tax responsibilities effortlessly.

In conclusion, the road to compliance is paved with proactive steps and reliable resources. By leveraging technology and expert advice, subcontractors can ensure compliance and focus more on their core business operations. The Pie Tax App presents a comprehensive support system, enhancing efficiency and ensuring peace of mind.

Frequently Asked Questions

What is the CIS scheme?

The CIS, or Construction Industry Scheme, is designed to improve tax compliance by regulating payments from contractors to subcontractors within the UK construction sector.

How can subcontractors verify others under CIS?

Verification is done through HMRC, where subcontractors register their hired parties to ensure proper tax deductions.

Why is record-keeping important in CIS?

Accurate records help maintain compliance, preventing penalties and ensuring smooth operations within construction projects.

What are the penalties for non-compliance with CIS?

Subcontractors can face financial penalties from HMRC for incorrect deductions or late tax submissions.

How does the Pie Tax App assist under CIS?

The app simplifies verification, record-keeping, and compliance processes, providing expert assistance to streamline subcontractor management.