Why Plumbers Need Specialised Accounting Software

If you are a plumber running your own business or operating as a sole trader, you understand how important accurate bookkeeping and tax filings are. However, doing your books manually is time-consuming and tedious. Accounting software for plumbers simplifies bookkeeping, ensures accuracy, and frees up time for more important things. This guide covers the best software options, features to look for, and answers FAQs about accounting software for plumbers.

Keeping track of your finances is crucial for any sole trader or SME owner. Inaccurate bookkeeping can lead to unreliable financial reports and erroneous tax filings, resulting in government audits, fines, and added interest. The right accounting software can minimise or eliminate errors, save time, and reduce audit risk. You’ll want software designed for sole traders and craftsmen, not multinational businesses.

Generate professional invoices quickly, customise them with your logo, and send electronically from your mobile device. This saves time and ensures faster payments. Track costs associated with each job easily, allowing you to determine profitability and make better estimates. Accurate tracking of job-related expenses is crucial for profitability. The software should offer simple expense tracking for each project. Generate accurate financial reports with a user-friendly interface.

Review your financial situation in real-time, identify trends, and measure performance against historical benchmarks. Customise features, layout, and functionality to suit your needs, including adding branding cues. Ensure the software can grow with your business, accommodating increased customer base and workload.

The Top 5 Accounting Software Programmes for Plumbers

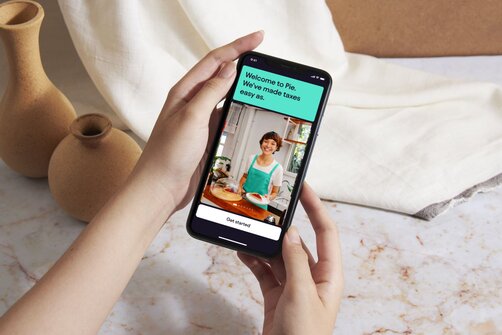

Pie

Pie represents the state-of-the-art in accounting software designed specifically for plumbers, sole traders, and other small to medium-sized enterprises (SMEs). With real-time updates and the latest tax information, Pie offers a clear, user-friendly dashboard that is easily navigable on smartphones. This innovative software transforms your mobile device into the hub of your bookkeeping and tax filing activities, allowing for quick data entry and automatic consolidation of your financial information.

In the realm of accounting software, Pie shines as a beacon of innovation, empowering users to navigate their financial journeys with confidence. Key features include a mobile app, real-time tax figures, bookkeeping, receipt reconciliation, open banking integration, multiple income and account management, direct HMRC submission, invoicing all included for Free. The app also offers tax support and advice with the tax assistance plan for £6.99pm and tax return checks for an additional £59.99.

What sets Pie apart is its focus on the unique needs of small businesses, ensuring that users are not overwhelmed by unnecessary features aimed at larger corporations. Designed with the sole trader and small business owner in mind, Pie maintains the same high level of data security and GDPR compliance expected from software used by the largest UK companies.

Key features include automatic program updates, full bookkeeping capabilities, invoice generation, support for multiple income streams, direct submission to HMRC, seamless bank integration, real-time tax figures, and expert support. As a CIMA-qualified accountancy practice approved and recommended by HMRC, Pie has leveraged its expertise to create a powerful accounting tool that benefits users in the plumbing industry and beyond.

90% of small business owners report that accounting software has significantly streamlined their financial processes. This highlights the critical role such tools play in managing business finances efficiently.Key Statistics on Financial Management for Plumbers

75% of plumbers experience delays in payments due to manual invoicing processes. Automated invoicing through accounting software can reduce these delays and improve cash flow.Key Statistics on Invoice Management

QuickBooks

QuickBooks was launched 40 years ago when competition in accounting software was minimal, allowing it to achieve significant name recognition and market penetration.

This success was driven by a robust product offering, including features such as cloud accounting, easy invoicing, integration with online banking, financial reporting, cash flow management, time tracking, and free unlimited support.

Over the years, QuickBooks has continuously improved and adapted to meet the needs of modern businesses, making it a go-to solution for many small and medium-sized enterprises.

QuickBooks offers various pricing plans to suit different needs, including Self-Employed at £10 per month, Simple Start at £14 per month, Essentials at £24 per month, Plus at £34 per month, and Advanced at £70 per month.

Each plan offers a range of features tailored to different levels of business complexity, ensuring that users can find the right fit for their accounting needs.

Whether you're a sole trader just starting or an established business looking for advanced tools, QuickBooks has a solution designed to help you manage your finances efficiently and effectively.

Essential Tips for Choosing Accounting Software as a Plumber

Streamlined Invoicing and Expense Tracking When selecting accounting software, ensure it can handle invoicing and expenses efficiently. Look for features that allow you to create professional invoices tailored for your plumbing services.

Tax Compliance Features Consider the software's compatibility with tax filing requirements. It should help you calculate your VAT and Self Assessment easily, ensuring you stay compliant and avoid potential fines..

Reliable Customer Support Lastly, evaluate the level of customer support offered. As a plumber, you want software that provides reliable assistance, especially during tax season or when you encounter technical issues.

FreshBooks

FreshBooks is an excellent choice for sole traders, particularly those who may not have much experience managing their own bookkeeping. Whether they have recently set up their business or have decided to cut expenses by letting their accountant go, FreshBooks offers a feature set that is ideal for plumbers and other professionals looking to minimize the time spent on bookkeeping and maximize their earning potential.

Key features include in-app estimates and proposals, a pre-populated Chart of Accounts, time tracking, third-party app integration, checkout links, and outstanding customer support. FreshBooks provides several pricing plans to accommodate various needs, including Lite at £12 per month, Plus at £22 per month, Premium at £35 per month, and a customizable package option.

Xero

Xero is a cloud-based accounting software that boasts an impressive array of features and seamless integration with many popular business applications. Although its interface may not be as clear and user-friendly as Pie’s, the extensive functionality compensates for this minor drawback.

Xero allows users to track both income and expenses, generate invoices and financial reports, and file directly with HMRC. Key features include invoice generation, customizable options, payroll processing, support for multiple currencies, robust data security, and the ability to file directly to HMRC.

Xero offers several pricing plans to suit different business needs: Starter at £15 per month, Standard at £30 per month, Premium at £42 per month, and Ultimate at £55 per month.

How is Pie different?

Pie is the only app for self assessment with tools for bookkeeping, your live tax figure, easy tax returns and helpful advice when you need it.

Save £168 per year vs Quickbooks, file your self assessment today for free with Pie

FREE

£89

+£59

£126

Quickbooks

£168

per year7 features

TaxScouts

£169

per year4 features

Accountant

£450

avg per year5 features

* Optional add on

Advice on Choosing Accounting Software

When selecting accounting software, consider the specific needs of your plumbing business. Evaluate the features offered by each option and determine which ones align with your requirements. For instance, if automated invoicing and bank reconciliation are crucial, prioritize software that excels in these areas.

It’s also important to consider the software’s scalability. As your business grows, your accounting needs will evolve. Choose a solution that can accommodate this growth without requiring a complete overhaul of your financial management system. The Pie Tax App, with its scalable features and expert tax assistants, is a great example of software that grows with your business.

Look for software with comprehensive financial tracking capabilities, including expense management and invoicing. This will help maintain accurate records and streamline tax preparation. Ensure the software integrates with your bank accounts for efficient transaction reconciliation.Feature Evaluation

Select accounting software that can grow with your business. This means choosing a solution that offers flexible plans and can handle increasing financial complexities as your plumbing business expands. The Pie Tax App’s scalable features make it an excellent choice for growing businesses.Scalability

Summary

In conclusion, selecting the right accounting software is vital for the success of your plumbing business. By choosing a tool that offers comprehensive financial tracking, seamless bank integration, and scalability, you can streamline your operations and focus on what you do best. The Pie Tax App, QuickBooks Online, Xero, and Zoho Books are all excellent options to consider. The Pie Tax App, in particular, provides real-time tax information and access to expert tax assistants, making it a valuable resource for plumbers looking to manage their finances efficiently.

Investing in the right accounting software can significantly improve your business’s financial health and operational efficiency. By leveraging the features and benefits of these tools, you can ensure accurate financial management, timely invoicing, and compliance with tax regulations. Choose the software that best fits your needs and watch your plumbing business thrive.

Frequently Asked Questions

Why is accounting software important for plumbers?

Accounting software helps plumbers manage their finances efficiently by automating tasks such as invoicing, expense tracking, and bank reconciliation, saving time and reducing errors.

What features should I look for in accounting software for plumbers?

Look for features such as automated invoicing, bank integration, expense management, and scalability to ensure the software meets your business needs.

How does the Pie Tax App benefit plumbers?

The Pie Tax App provides real-time tax information and access to expert tax assistants, helping plumbers stay compliant with tax regulations and manage their finances effectively.

Are there affordable accounting software options for small plumbing businesses?

Yes, there are several affordable options, including QuickBooks Online and Pie tax, which offer various pricing plans to suit different business sizes and needs.

Can accounting software help with tax compliance?

Absolutely. Accounting software like the Pie Tax App offers features that help plumbers stay compliant with tax regulations by providing real-time tax information and support from expert tax assistants.